|

|

||

|

Peterson Grain Co.

Market Data

News & Commentary

Weather

|

Are Wall Street Analysts Bullish on Aon Stock?/Aon%20plc_%20building%20photo-by%20J2R%20via%20iStock.jpg)

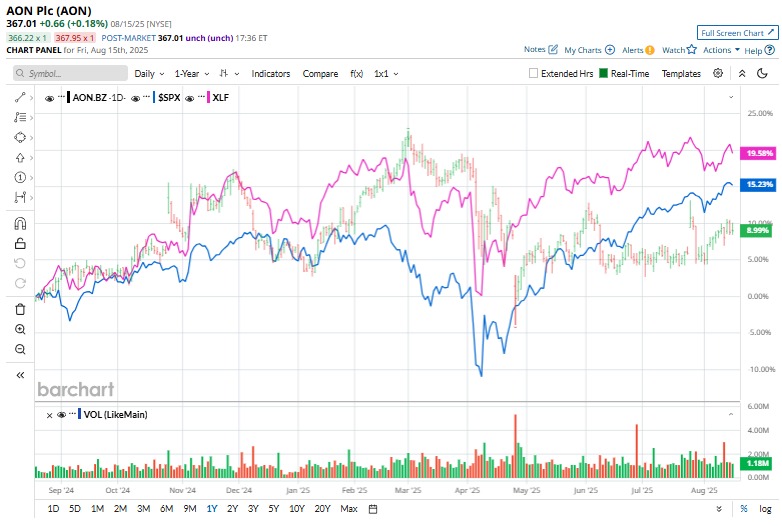

With a market cap of $79.1 billion, Aon plc (AON) is a global professional services firm specializing in risk management, human capital consulting, insurance, and reinsurance brokerage. Based in Dublin, Ireland, it serves clients in over 120 countries through its Commercial Risk Solutions, Reinsurance Solutions, Wealth Solutions, and Health Solutions segments. The company's shares have underperformed the broader market over the past 52 weeks. AON shares have gained 10.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 16.4%. Moreover, shares of AON are up 2.2% on a YTD basis, slightly lagging behind SPX’s 9.7% rise. In addition, the insurance brokerage has also trailed the Financial Select Sector SPDR Fund’s (XLF) 20.7% return over the past 52 weeks and 8.6% in 2025.

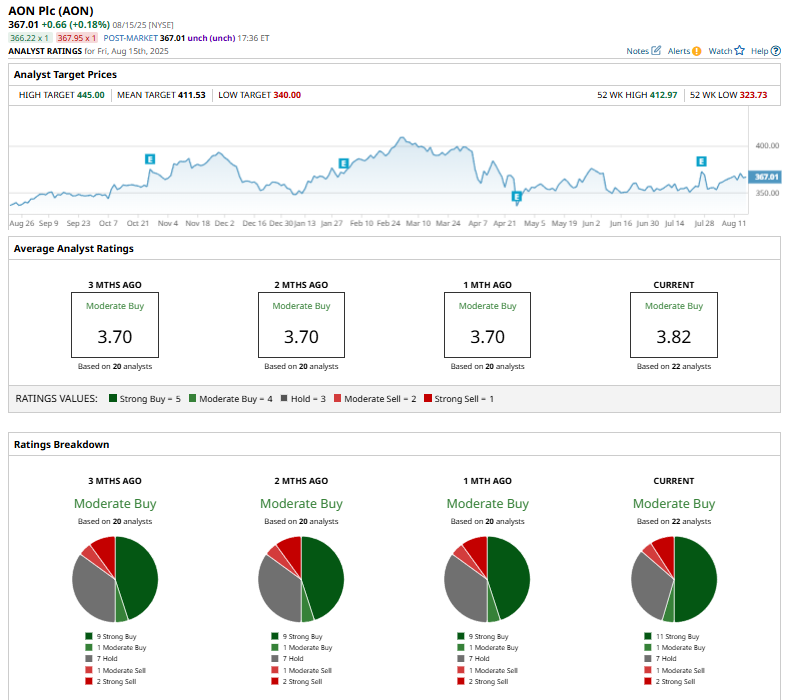

On Jul. 25, AON shares climbed 4.6% after the company released its second-quarter earnings. Its revenue surged 11% year-over-year to $4.16 billion, including 6% organic growth. Adjusted operating income increased 14% to $1.17 billion, driving an expanded operating margin of 28.2%. Adjusted EPS also improved, climbing 19% to $3.49. Cash flow was a standout, as free cash flow surged 59% to $732 million, supported by a 55% jump in cash from operations. Management highlighted these results as evidence of strong execution of its Aon United strategy and reaffirmed confidence in full-year 2025 guidance. For the current fiscal year, ending in December 2025, analysts expect AON’s adjusted EPS to grow 8.1% year-over-year to $16.86. However, the company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on one occasion. Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” seven “Holds,” one “Moderate Sell,” and two “Strong Sells.”

This configuration is more bullish than a month ago, with nine “Strong Buy” ratings on the stock. On Aug. 13, Citigroup Inc. (C) analyst Matthew Heimermann initiated coverage on Aon with a “Neutral” rating and a $402 price target, setting a new benchmark for the stock’s valuation. AON’s mean price target of $411.53 implies that the stock could rally by 12.1% from the prevailing price levels. The Street-high price target of $445 indicates a potential upside of 21.3% from the current price levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|